31+ Monthly debt payment calculator

Negative equity raises the amount you need to borrow and your monthly payment as your new auto loan has to cover your new car and your old one. HELOCs take up less than 1 of the debt held by those age 1829 and 1 of the debt held by those ages 3039 but that percentage rises to 6 for those 70.

![]()

The Measure Of A Plan

P1r12 n 1r360d -P.

. Back-end DTI adds your existing debts to your proposed mortgage payment. Compare your monthly debt payments and housing expenses to your gross household income. Recipientssuspended all federal student loan payments and waived interest charges on federally held loans until 123122.

Presuming your gross monthly income is 6500 lets calculate your back-end DTI ratio using the following financial details. N is the number of months. See the table and the results below.

If an Option-ARM has a payment cap of 6 and your monthly loan payment was 1000 per month then the payment amount wont go above 1060 the following year. If you dont know the monthly mortgage payment for the home you would like to purchase. If you have a low debt-to.

It can be used for any type of loan like a car home motorcycle boat business personal student loan debt credit card debt etc. Payment caps are similar to rate caps but they apply to how much your monthly payment can change each year rather than the rate of interest. R is the Prompt Payment interest rate.

D is the number of days for which interest is being calculated. This is typically generated by an amortization calculator using the following formula. And they dont even require a change in the total monthly payment.

March 31 2018 By Topic. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Second mortgage types Lump sum.

Debt service calculator. This number doesnt necessarily portray a detailed picture of your financial strengths and weaknesses but it does give lenders the thumbnail sketch of your finances they need to make a decision. The estimated monthly payment on a 20000 loan can range from 368 and 1181 per month depending on your interest rate and term.

Whats the monthly payment based on interest rate. In response to the crisis the Federal Reserve quickly expanded their balance sheet by over 3 trillion Dollars. This is the formula the calculator uses to determine monthly compounding interest.

P is the amount of principal or invoice amount. Loans of this size are on the higher end of what some lender offer and could be eligible for longer loan terms which can lower your monthly payments but increases the amount you pay in total interest. The law changed the maximum deductible limit to the interest on up to 750000 of total mortgage debt for married.

Make your student. This is regardless of whether index rates rise or fall. If they had no debt their ratio is 0.

D is the number of days for which interest is being calculated. For example if your total monthly income is 7000 then your housing payment shouldnt be more than 2170 to 2520. Use our payoff calculator and see for yourself.

New Cars for Sale. Avoiding debt is a good idea but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your accounts activity and build its on-time payment history.

For instance if your debt costs 2000 per month and your monthly income equals 6000 your DTI is 2000 6000 or 33 percent. If the Loan Date is May 15th and the Payment Frequency is Monthly then the First Payment Due should be set to June 15th that is IF you want a conventional interest calculation. This is the formula the calculator uses to determine simple daily interest.

Calculator Rates Balloon Loan Calculator. In Q2 of 2020 the United States economy collapsed at an annualized rate of 317. A program of the Bureau of the Fiscal Service.

Older Americans have the highest percentage of HELOC debt. The monthly payment reflects both the repayment for the cash out at closing and your monthly mortgage payment. Use this calculator to find the monthly payment of a loan.

Back-end DTI ratio Total Monthly Debts Gross Monthly Income 100. R is the Prompt Payment interest rate. Loan Payment Tables by Length and Interest Rate for a 150000 Dollar Loan.

Show current payments for. Payment and debt ratios. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out at closing and change your loan term to 5 10 15 or 20 years.

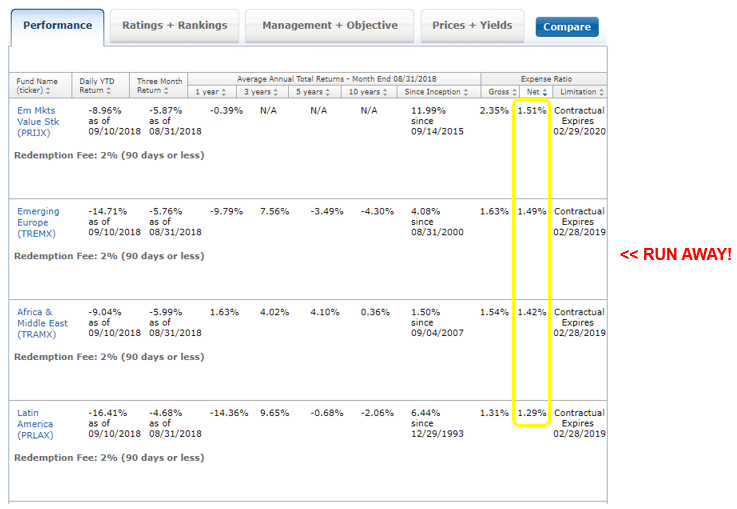

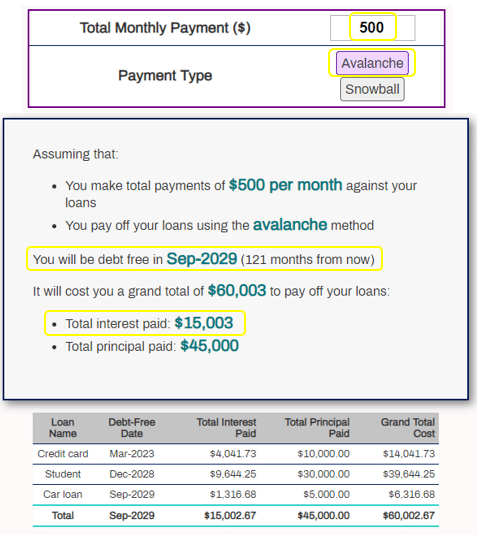

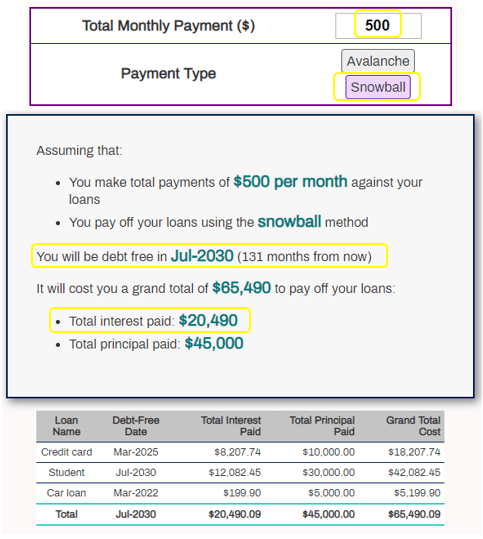

This multiple debt payoff calculator tests 5 debt payoff methods to tell you including debt snowball debt avalanche. Second mortgages come in two main forms home equity loans and home equity lines of credit. See Long Period Options and Short Period Options below for additional details about payment amounts and interest calculations.

Imagine you purchase a 360000 property with 60000 as a down payment and the interest rate on your 30-year home loan is 3. Monthly compounding interest the formula. This means your monthly payments will also remain the same.

As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48. Use our car payment calculator to see how much your monthly payment would beplus learn why monthly car payments arent as innocent as they seem. Please carefully consider these changes before refinancing.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. The average interest rate lenders charge. Pr360d P is the amount of principal or invoice amount.

This tool figures a loans monthly and balloon payments based on the amount borrowed the loan term and the annual interest rate. Use our car payment calculator to determine what your monthly car payments will be. 431 for a new car loan and 843 for a used car loan.

31 32 33. For most people housing is their biggest monthly expense. And theyre going to want that money back.

For monthly payments over 30 years 12 months. For a monthly payment take the Annual Rate12 is the number of payments. Then once you have calculated the monthly payment click on the Create Amortization Schedule button to create a report you can print out.

A quick look at a mortgage calculator. As long as you make consistent payments your debt should be paid off within 30 years. Explore personal finance topics including credit cards investments identity.

For example if you took a 30-year fixed-rate loan your payments will not change for the next 30 years. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Current Payment Interest Rate Day Due 1-31 Compounding Priority.

31 Free Personal Finance Homeschool Resources

Pin On Bible Study

How To Start A Budget Journey To Financial Freedom Budgeting Budgeting Tips Budgeting System

The Measure Of A Plan

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

Free 9 Sample Loan Amortization Chart Templates In Ms Word Pdf Excel

How To Save Money Fast 3 Tricks Above 1000 Hr

How To Pay Off Debt Fast Myhomeanswers

Emergency Fund Is 1k Actually Enough Our Bill Pickle Emergency Fund Emergency Fund Saving Retirement Quotes Funny

The Measure Of A Plan

31 Free Personal Finance Homeschool Resources

How To Pay Off Debt Fast Myhomeanswers

Pin On Bible Study

20 Life Changing Financial Freedom Books The Minted Latte

Free 9 Sample Loan Amortization Chart Templates In Ms Word Pdf Excel

The Measure Of A Plan

Free 9 Sample Loan Amortization Chart Templates In Ms Word Pdf Excel